Q4 2025 Market Update

At the start of the new year, it is always a good opportunity to reflect on what shaped investment markets over the past 12 months and look ahead to the practical steps that can help keep your finances on track.

Despite ongoing geopolitical tensions and political uncertainty, 2025 proved to be a strong year for investors across most major markets. At the same time, changing tax rules make forward planning more important than ever.

In this edition, read expert insights on:

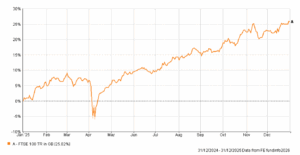

How the FTSE 100 closed the year on a high – up 21.5% on New Year’s Eve

Looking ahead to 2026 – what should we expect

Planning tips to help you prepare your finances before the end of the tax year

How the FTSE 100 closed the year on a high – up 21.5% on New Year’s Eve

At the end of a strong year for global equities, on New Year’s Eve, the FTSE 100 closed up 21.5% compared with the start of January 2025.

Increasing in value by a fifth over 2025 – its biggest annual gain since 2009 – the UK market also beat Wall Street returns, giving investors plenty of reason to party.

In fact, 2025 was a strong year for global stock markets. Despite periods of uncertainty (in particular when President Trump announced sweeping tariffs on trading partners in April) and ongoing geopolitical events, 2025 was the first year since the pandemic where all major stock markets delivered positive returns.

| UK FTSE All-Share | Japan TOPIX | MSCI Asia ex-Japan | MSCI Europe ex-UK | MSCI Emerging Markets | US S&P 500 | |

| 2025 | 24.00% | 25.50% | 33.00% | 25.50% | 34.40% | 17.90% |

| Q4 2025 | 6.40% | 8.80% | 4.30% | 5.90% | 4.80% | 2.70% |

| Q3 2025 | 6.90% | 11% | 11.10% | 2.80% | 10.90% | 8.10% |

| Q2 2025 | 4.40% | 7.50% | 12.70% | 3.60% | 12.20% | 10.90% |

| Q1 2025 | 4.50% | -3.40% | 1.90% | 6.40% | 3% | -4.30% |

Source: JP Morgan

As you can see from the table above, all the major stock markets made good gains in 2025 and, contrary to public perception, the US market underperformed all the other markets listed in the table. This once again supports the value of diversifying your investments in both positive and negative markets.

Read more: 5 interesting insights from the investment market in 2025

Looking ahead to 2026 – what should we expect

The first days of 2026 suggest that geopolitical uncertainty will remain for the foreseeable future as US rhetoric continues at a pace. At the time of writing, President Trump is eyeing Greenland, saying that it is key for both the US and Europe’s national security. Though he doesn’t have a specific “timeline” for taking action, his intent is “very serious”.

Elsewhere, political tensions in Venezuela remain elevated. With President Nicolás Maduro currently held prisoner in the US, President Trump has demonstrated his clear determination to crack down on the international drugs trade.

Large scale civil unrest in Iran, driven by an economy weakened by government mismanagement and corruption, as well as sanctions over Iran’s nuclear programme, has been further exasperated by President Trump’s suggestions of intervention by the US.

Meanwhile, despite several attempts to broker peace talks, Russia and Ukraine continue the war. With 27 global leaders having met in Paris to finalise a proposal on security guarantees that can be taken to Russia, we can only hope that we see real progress soon.

Such developments can create short-term uncertainty, but they also serve as a reminder that geopolitical risk is unpredictable, reinforcing the importance of diversification and a long-term investment approach.

While headlines like to predict what might happen around the world and on the stock markets in 2026, none of us has the power to control events.

Instead, one of the best ways to control your financial future is to plan ahead. As the end of the tax year approaches, a little forward planning can make a meaningful difference.

Planning tips to help you prepare your finances before the end of the tax year

In the Autumn Budget, the chancellor announced that both Income Tax and Inheritance Tax (IHT) thresholds will remain frozen until April 2031. This means more of your income and wealth may be exposed to tax over time.

Read more: How fiscal drag could harm your finances as the government extends tax freezes

Right now, here are five areas worth reviewing before 5 April.

Review your dividend income

From April 2026, ordinary and upper rates of tax on dividend income will rise by 2%.

| Tax band | Dividend Tax 2025/26 | Dividend Tax 2026/27 |

| Basic | 8.75% | 10.75% |

| Higher | 33.75% | 35.75% |

The additional rate will remain at 39.35%.

While dividends are likely to remain key to efficient profit extraction, you may need to review what’s best for you before the end of the tax year. For example, you may be able to reduce unnecessary tax by making better use of ISAs or spreading income between you and your spouse.

Make the most of pension contributions

Pensions remain one of the most tax-efficient ways to save for the future. Making or increasing pension contributions before the end of the tax year could help you:

- Reduce your income tax bill

- Boost long-term retirement savings

- Take advantage of employer contributions, where available.

Tax-efficient pension contributions are generally limited to £60,000 gross per year, or 100% of earnings – whichever is lower.

However, carry forward rules allow you to use unused allowances from the last three tax years, meaning you may be able to contribute more and still claim all the available tax relief.

Use your ISA allowance

In the 2025/26 tax year, you can invest up to £20,000 into ISAs, helping your wealth grow tax-free.

This is a use-it-or-lose-it allowance, so be sure to maximise your ISA before you miss the chance.

If you’re planning as a couple, you can save £40,000 tax-efficiently, helping to reduce future tax bills and provide greater flexibility when you’re ready to draw income in retirement.

Use your gifting allowances

As with the ISA allowance, gifting allowances reset each tax year. You can gift up to £3,000 each year (plus certain small gifts) without it forming part of your estate for IHT purposes.

Used consistently over time, making the most of all your IHT gifting allowances could help reduce the value of your estate while allowing you to support your family during your lifetime.

On a final note, the basic and new State Pension will increase by 4.8% from 6 April 2026. If you’re entitled to the full new State Pension, you can expect to receive £241.30 each week, up from £230.25.

We’re here to help you plan ahead with confidence

As we look ahead to 2026, change and uncertainty will likely continue. This is nothing new, but remember: history shows that staying focused on well-defined goals is what delivers results over time.

Whatever the coming 12 months bring, we’re here to help you make sense of the noise, stay disciplined, and keep your plan on track.

As always, we remain committed to supporting you with clear advice and steady guidance through every stage of your financial journey.

If you have any questions about anything you have read in this update, please do not hesitate to contact your financial planner, who will be happy to give you all the support you need.

| Please note:

This article is for general information only and does not constitute advice. The information is aimed at retail clients only. All information is correct at the time of writing and is subject to change in the future. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change. The Financial Conduct Authority does not regulate estate planning or tax planning. A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts. Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief. Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer. |