Q4 2024 Market Update

Following on from a strong finish to 2023, when we saw stock markets begin to show signs of recovery as inflation started to ease around the world, 2024 continued to offer positive returns for much of the year.

Albeit there was a slight decline in December 2024, relating to concerns about sticky inflation, most investors finished the year in confident mood.

In this edition, read expert insight about:

- Reflecting on 2024 – A good year for US equities

- Will Trump policies boost US growth?

- How the UK economy is fairing after the Autumn Budget

Reflecting on 2024 – A good year for US equities

Overall, 2024 was a good year for investors.

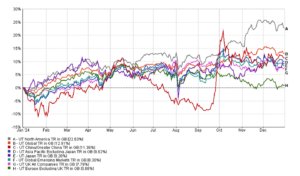

As the chart below shows, there were mixed returns for some markets while US equities continued to show consistently strong returns.

Source: FE fundinfo

The performance of US equities was certainly boosted by the growth in the “Magnificent Seven” – the seven US tech giants formed of Alphabet (Google), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.

Nvidia lead the pack with +171.2% growth and Microsoft came in seventh position, with a humble +12.1% growth.

| Company | 2024 Performance |

| Alphabet (Google) | +35.5% |

| Amazon | +44.4% |

| Apple | +30.1% |

| Meta Platforms | +65.4% |

| Microsoft | +12.1% |

| Nvidia | +171.2% |

| Tesla | +62.5% |

Source: Investor’s Business Daily

Will Trump policies boost US growth?

No matter what your opinion is about the re-election of President Trump, the market response was overwhelmingly positive following the announcement of his election.

Today sees his inauguration and, whatever changes Trump manages to implement once he’s back in the White House, there are three key policy areas with potential economic and market ramifications that he’s consistently focused on: immigration, tariffs, and tax.

While we wait to find out the detail of any changes we may see under a second, potentially less impeded, Trump administration, it’s likely that we’ll see lower taxes for individuals and businesses alike, with meaningful cuts in regulation.

Ultimately, lower levels of taxation and regulation are usually good news for stock markets. If Trump gets his way, those living in the US may end up with more money to invest, and companies will be able to keep more of their profits.

On the flipside, though Donald Trump’s proposed fiscal policies are designed to materially boost growth, potential policy changes, which involve significant tax cuts, could also lead to higher inflation.

According to Reuters’ report on the latest Survey of Consumer Expectations for the Fed bank, respondents expect to see “inflation a year from now steady at 3%…”.

Only time will tell.

How the UK economy is fairing after the Autumn Budget

Looking closer to home, there’s increasing pressure on sterling and UK gilt yields as investors worry about fiscal sustainability following the November Budget.

In fact, the UK economy experienced zero growth between October and December 2024.

As a result, the Bank of England (BoE) predicts that inflation will edge up to 2.75% in the second half of 2025 before falling again. Though, in December, UK inflation unexpectedly dipped for the first time in three months.

Source: BBC (ONS)

Though the BoE cut interest rates twice in 2024 in response to falling inflation – to 5% in August and 4.75% in November – it held rates at 4.75% at its final 2024 meeting in December.

Rising pay growth, which grew to 5.2% in October, also plays in, increasing the pressure on the BoE to hold interest rates.

Source: BBC (ONS and Bank of England)

Meanwhile, the impending cost increases for businesses that come into effect in April, including higher National Insurance contributions and National Living Wage, may be weighing heavily on the jobs market.

Indeed, hiring data for November suggested demand for UK staff was abnormally weak in the run-up to the busy Christmas period.

Read more: The Key Autumn Budget Takeaways Business Owners Should Be Aware Of

It’s not just employer National Insurance that is increasing. As you may recall from our Autumn Budget summary, almost every area is being squeezed for tax. It remains to be seen if the new government can drive the growth required to alleviate market concerns.

Meanwhile, always remember that stock market volatility is part and parcel of investing. A well-balanced portfolio is designed with this in mind. And your best approach is to focus on the long-term horizon.

If you’d like to discuss about how frozen thresholds and impending tax rises could affect your finances and those of your business, please get in touch. We’ll work with you to understand what it means for you and explain steps you could take to reduce the eroding effects on your wealth.

We’re here to help

As financial planners, we’ve helped clients weather many economic storms over the years, and that’s something my team and I are proud to continue doing.

Markets may rise and fall, but your investment goals should remain the same, and it’s our job to help you achieve them. For 20 years, clients like you have trusted us to provide honest, independent advice in a friendly and professional way.

If you have any questions about anything you’ve read in this update, please don’t hesitate to contact your financial adviser, who’ll be happy to give you all the support you need.

| Please note:

This article is for general information only and does not constitute advice. The information is aimed at retail clients only. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. |

| Sources:

Published January 2025: Magnificent Seven Stocks: Nvidia Dives Below Key Level; Tesla Slides| Investor’s Business Daily Published 13 January 2025: New York Fed survey finds mixed inflation expectations in December | Reuters Published 15th January 2025:UK inflation fall boosts hopes of interest rate cut – BBC News Published 15th January 2025: UK inflation rate: How quickly are prices rising? – BBC News |