Q3 2025 Market Update

After a volatile start to the year, markets were relatively calm in the third quarter of 2025, with central banks largely maintaining existing interest rate policies and investors adjusting to ongoing trade developments.

Against this backdrop, well diversified, risk-aligned portfolios delivered steady returns over the quarter, supported by resilient corporate earnings and continued strength in technology. Economic data remained broadly stable, helping underpin confidence as markets looked ahead to the final months of the year.

In this edition, read expert insights on:

- A steady quarter for most investors

- Tech is thriving, but your plan should stay diversified

- All eyes on the chancellor ahead of the Autumn Budget

A steady quarter for most investors

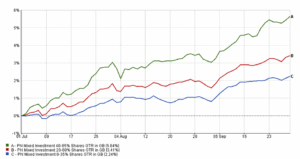

The third quarter of 2025 was steady and positive for investors, with markets showing welcome stability after a volatile start to the year. The graph below shows how the main mixed investment sectors delivered positive returns over the period.

Source: FE fundinfo

As part of our financial planning process, we ensure our clients’ investments align with their personal attitude to risk. Typically, higher-risk investments can experience larger movements in value but offer greater potential for longer term growth, while lower-risk investments tend to fluctuate less and provide steadier returns.

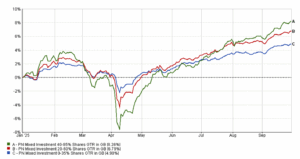

The graph below illustrates this clearly. Since the start of the year, portfolios with more exposure to equities have produced stronger overall returns but also experienced larger short-term dips, particularly around events such as President Trump’s “Liberation Day” announcement. More cautious portfolios were steadier but still benefited from broadly positive market conditions during the quarter.

Source: FE fundinfo

Once again, this highlights the importance of holding investments that reflect your goals and comfort with risk, helping you stay informed, confident, and focused on the bigger picture.

Tech is thriving, but your plan should stay diversified

Technology, particularly artificial intelligence, has continued to drive much of the market’s growth this year. The impressive performance of leading global tech companies has lifted returns across many portfolios, reinforcing how innovation can create lasting opportunities for investors.

Most diversified portfolios already include some exposure to these major technology firms through global equity or multi-asset funds. This means investors are benefiting from the sector’s strength — but as part of a broader, balanced approach designed to manage risk effectively.

Because much of this growth has been concentrated in a small number of firms, markets can be more sensitive to changes in sentiment or policy. That is why diversification remains at the heart of every sound financial plan. By setting an asset allocation that reflects your goals and attitude to risk, and by staying disciplined through market cycles, you can benefit from progress in areas like technology without becoming overexposed to it.

This approach helps you remain confident and focused on your long-term objectives, allowing the various parts of your portfolio to do their job over time.

All eyes on the chancellor ahead of the Autumn Budget

With growing discussion in the media about a spending gap and the possibility of future tax changes, the upcoming Autumn Budget on Wednesday 26 November has drawn plenty of attention.

Commentators suggest the Chancellor is under pressure to raise revenue, with estimates indicating the government may need to find between £20 and £50 billion to meet its own fiscal rules.

While speculation is likely to continue, it is important to remember that these discussions are a normal part of the political and economic cycle. If changes are announced, we will assess what they mean and how they might affect different areas of financial planning. There are often steps that can be taken to adapt as details become clearer.

Once the Budget has been delivered, we will share a clear summary of the key announcements, focusing on what they mean in practical terms for you. Our goal is to help you understand the facts, avoid unnecessary worry, and stay focused on your long-term objectives.

Looking ahead with confidence

Periods of change and uncertainty are nothing new for investors, and history shows that staying focused on well-defined goals is what delivers results over time. Our role is to help you make sense of the noise, stay disciplined, and keep your plan on track, whatever the headlines.

As always, we remain committed to providing insight to empower and improve lives, supporting you with clear advice and steady guidance through every stage of your financial journey.

If you have any questions about anything you have read in this update, please do not hesitate to contact your financial planner, who will be happy to give you all the support you need.

| Please note:

This article is for general information only and does not constitute advice. The information is aimed at retail clients only. All information is correct at the time of writing and is subject to change in the future. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change. The Financial Conduct Authority does not regulate estate planning or tax planning. A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts. Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief. Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer. |