Q2 2025 Market Update

You may recall reading about the immediate fallout of Trump’s “Liberation Day” in our last market update.

In the second quarter of 2025, markets have again proved resilient, having already made a full recovery since the shock of Trump’s tariff announcement on 2nd April, despite ongoing geopolitical events.

As the conflict between Russia and Ukraine continues to rumble on, attention has turned to the situation in the Middle East. Following intense conflict, at the time of writing, President Trump’s actions have contributed to a “fragile” Israel-Iran ceasefire agreement.

In this edition, read expert insight about:

- The FTSE 100 reaches record highs despite weak UK economic data

- Speculation continues around how Labour might address a £5bn spending gap

- Global markets continue to show resilience amid persistent uncertainty

The FTSE 100 reaches record highs despite weak UK economic data

Despite poor economic data from the UK, and barely any news headlines covering the milestone, the FTSE 100 closed at a record high on 12th June. This was thanks to softer than expected labour market figures, which many believe could increase the chance of more interest rate cuts later in the year.

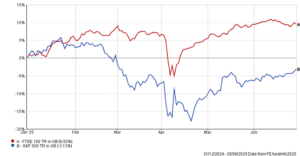

Here’s a chart showing how the FTSE 100 has quietly made relatively steady gains since the turn of the year when compared against the volatility of the headline grabbing US equity market:

Source: FE fundinfo

As you can see, the FTSE 100 (red line) was less impacted by the effect of President Trump’s second term in office and tariff announcements, allowing UK Equities to reach new highs in June – while the S&P 500 (blue line) in the US still has some ground to make up the levels reached at the start of 2025, and in the days following President Trump’s second inauguration.

Speculation continues around how Labour might address a £5bn spending gap

Contending with weak economic growth and stretched public services, Rachel Reeves (or her potential successor) will be preparing the Autumn Budget under pressure to raise government funds in order to stick to her own fiscal rules.

Though the UK economy grew more than expected in the first quarter of the year, it’s now showing signs of slowing. In April 2025, it shrank by 0.3%.

In May, government borrowing hit a staggering £17.7 billion. Indeed, New Statesman reports that, “Our debts are almost the same size as our entire economy, and our borrowing costs are the highest since 2008.”

A little under two months on, and costs are set to rise further following the U-turn on the welfare bill. According to the Independent, this combined with the winter fuel payments, could leave a £5-billion hole in Labour’s spending plans.

Having promised not to raise Income Tax, National Insurance, or VAT, Reeves has her back against the wall as she debates whether she can afford to break that promise. And if she doesn’t, what options does she (or a new Labour chancellor) have?

Play with personal tax thresholds

With personal tax thresholds frozen since 2021, and rising costs, many people are already suffering from the effects of fiscal drag. And yet one available option may be to extend the freeze on personal allowances.

This would increase the government’s tax take, without actually being a tax rise.

Scale back salary sacrifice arrangements

Current rules allow employees to exchange a chunk of their pay for a pension contribution, meaning you pay less Income Tax. You and your employer also pay less National Insurance.

An HMRC report published in May investigated the potential to change the rules, raising fears that the tax-efficient scheme could be amended in the government’s favour.

Pare back pension tax relief

Pensions are already in line for a change – from April 2027, pension savings will come into scope for Inheritance Tax.

However, the government may consider adjusting the amount of tax relief on contributions, or else tamper with the tax-free cash you can draw from your pension when you retire.

Investigate taking more from investments

Though Dividend Tax was mentioned in a leaked memo from March, another area that may be investigated is ISAs. Reeves is rumoured to be considering changes to the Lifetime ISA.

She may also reduce the amount you can save into a Cash ISA in an attempt to encourage people to invest in Stocks and Shares ISAs instead.

Tinker with taper relief

Potentially exempt transfers allow you to transfer your wealth free of IHT, so long as you survive for seven years after making the gift.

Taper relief kicks in after three years, reducing the amount of IHT that may be due if you pass away. For each year you survive, the rate of IHT due falls – until arriving at zero in year seven.

Increasing the IHT charge on this rule could be an option, though experts suggest it might not raise much more cash.

Global markets continue to show resilience amid persistent uncertainty

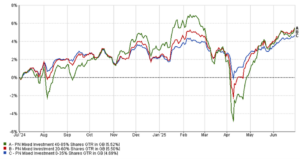

As the chart below shows, global markets have once again proved their resilience during the second quarter of 2025.

Source: FE fundinfo

Equity markets have regained most, if not all, of the losses incurred following President Trump’s Liberation Day announcement, despite ongoing economic and geopolitical uncertainty.

Indeed, the Global Economic Policy Uncertainty Index, which has data going back to 1996, currently has its highest reading since we were in the early stages of the Covid crisis.

This is largely due to America’s aggressive trade policy and geopolitical factors – most notably the ongoing war between Ukraine and Russia, and the Israel-Iran conflict.

Recent events in the UK have also created uncertainty.

During Prime Minister’s Questions on Wednesday 2 July, the first since the welfare bill U-turn, Keir Starmer refused to guarantee that Rachel Reeves would still be chancellor by the autumn.

In the minutes and hours following Starmer’s comments, the value of the pound dropped and government borrowing costs rose.

- Sterling dropped to a week-long low, hitting $1.35 for the first time since 24 June.

- The pound fell to €1.15, a rate not seen since mid-April in the aftermath of President Donald Trump’s tariff announcements.

- UK’s benchmark 10-year gilt yield rose to 4.67%, a high last recorded on 9 June.

- 30-year gilt yields hit 5.45%, a level not seen since 29 May.

These movements eased back very quickly in the hours after the parliamentary session, as a spokesperson stepped in to quell fears over the chancellor’s future.

According to Sky News, “the prime minister made clear to the chancellor that she has his ‘complete support’ and remains integral to his project”.

While headlines scream for your attention, instead of responding to the hype, you’re better served by taking a moment to reflect on what matters to you. Although stock market returns will always fluctuate, your goals won’t.

Plus, your portfolio is well-diversified and aligned with your personal attitude to risk.

Ultimately, while financial markets react to events, history has shown that, over the long term, stock markets typically recover.

We’re here to help

As financial planners, we have helped clients weather many economic storms over the years, and that is something my team and I are proud to continue doing.

Markets may rise and fall, but your investment goals should remain the same, and it is our job to help you achieve them. For 20 years, clients like you have trusted us to provide honest, independent advice in a friendly and professional way.

If you have any questions about anything you have read in this update, please do not hesitate to contact your financial planner, who will be happy to give you all the support you need.

| Please note:

This article is for general information only and does not constitute advice. The information is aimed at retail clients only. All information is correct at the time of writing and is subject to change in the future. You should not take any investment decision based solely on this information. All content is based on our understanding of HMRC legislation, which is subject to change. |

| Sources:

Published 2nd July 2025: Welfare bill: just raise tax – New Statesman Published 2nd July 2025: How markets reacted to uncertainty over Rachel Reeves’s future | Money News | Sky News Published 28th June 2025: Starmer ‘must hike taxes’ to plug £4.5bn black hole after welfare U-turn | The Independent Published: Economic Policy Uncertainty Index |