Q2 2024 Market Update

Following the brief recession at the end of 2023, the UK economy looks set to fare better throughout the second half of 2024 but, with many households and businesses still feeling far from comfortable, recovery remains fragile. However, the combining factors of lower inflation, strong wage growth, and (potentially) falling interest rates should help to boost consumer confidence, increasing spending and business investment.

In this edition, read expert insight about:

- Inflation finally hits the target

- The election and your financial plan

- A steady start to 2024

Inflation finally hits the 2% target

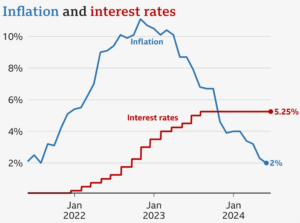

The UK’s economic improvement is expected to be primarily driven by inflation. And, in June 2024, the Office for National Statistics (ONS) finally announced that it had reached the Bank of England’s (BoE) 2% target – the lowest rate seen in nearly three years.

Sticky inflation has been a constant headline story, and one that you’ll likely be tired of hearing, but attaining 2% is a significant milestone. It doesn’t mean you’ll notice the difference when you’re doing your grocery shop, but prices are rising less slowly.

Since the BoE uses interest rates to control inflation, there will be increasing pressure for the Bank to act or justify a decision to keep higher-than-normal rates, with an interest rate cut in August now looking likely.

In the meantime, Andrew Bailey, the Bank’s governor, has said, “It’s good news that inflation has returned to our 2% target. We need to be sure that inflation will stay low and that’s why we’ve decided to hold rates at 5.25% for now.”

Source: BBC

With all eyes on the election, what might it mean for your financial plan

The positive inflation news was one of the key drivers behind Rishi Sunak standing in the pouring rain to announce that the general election would take place on 4 July 2024, and the UK isn’t the only country heading to the polls in 2024.

Indeed, Reuters report that no less than 64 countries are holding elections. Together, they represent around 60% of the world’s total economic output.

As we write, the contending UK parties have all shared their visions and published their manifestos, but your overarching concern is probably how it will affect your financial plan.

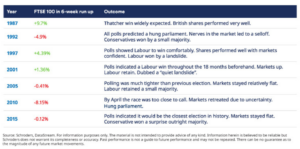

While data suggests that general elections can affect stock market returns, it’s hard to predict which way things will go. Indeed, data from Schroders reveals that while the weeks leading up to an election can be a volatile time for the markets, how they react to an upcoming election often depends on how predictable the outcome is.

The table below shares fascinating insight into how the FTSE 100 performed in the six weeks running up to a general election in the UK between 1987 and 2015.

Source: Schroders

This highlights that the most dramatic changes to the FTSE occurred:

- In 1987 – when a Thatcher win was highly anticipated, leaving little room for uncertainty, shares performed well. The market grew 9.7% in the six weeks prior to the election.

- In 2010 – when it was impossible to predict what the outcome would be. Uncertainty abounded, and returns fell 8.15% in the six weeks prior to the election.

Though lots of data shows there may be historical trends linking elections and market returns, when it comes to forecasting market performance, research from US Bank concludes that, actually, economic data plays a far more significant role than politics.

As such, attempting to make investment decisions based on the outcome of the UK or US election is unlikely to result in reliable portfolio growth. Rather, well-diversified investments could help to balance out any short-term volatility that may affect your portfolio.

Finally, remember to keep your personal goals and circumstances front of mind and don’t allow yourself to be swayed by the inevitable speculation that’s swirling around at the moment.

A steady start to 2024

Despite the many political footballs being volleyed about more recently, investment performance has been relatively positive during the first six months of the year. This has been largely driven by global equity markets, with US equities leading the way. Tech stocks continue to dominate the US growth story with talks of a tech bubble appearing to be somewhat premature at this time.

Meanwhile, bond markets are yet to make any meaningful recovery following the volatility seen during Liz Truss’ short lived period as prime minister in the late summer/early Autumn of 2022, and have been relatively flat in recent times. However, yields are now higher than they’ve been in a long time and well above inflation. If inflation continues to fall, and interest rates start to edge down, capital values should start to rise. At the very least, bonds are now offering some nice yields with, what would appear to be, little capital downside.

Property funds have shown mixed returns with ‘bricks and mortar’ funds remaining flat compared to property equity funds which, like most equity markets, have shown positive returns during this time. Again, expected reductions in interest rates should have a positive impact.

Last but not least, cash rates are now offering above inflation returns but appear to have peaked with interest rate reductions very much on the horizon.

Of course, when investing we have to accept that we don’t actually know what is round the corner and, while things look relatively positive in the short term, we must take a longer-term approach and plan accordingly.

We’re here to help

As financial planners, we’ve helped clients weather many economic storms over the years, and that’s something my team and I are proud to continue doing.

Markets may rise and fall, but your investment goals should remain the same, and it’s our job to help you achieve them. For almost 20 years, clients like you have trusted us to provide honest, independent advice in a friendly and professional way.

If you have any questions about anything you’ve read in this update, please don’t hesitate to contact your financial adviser, who’ll be happy to give you all the support you need.

| Please note:

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. |

| Sources:

Published 19th June 2024: Consumer price inflation, UK – Office for National Statistics Published 15th January 2024: How an election-packed 2024 could swing world markets | Reuters Published 2nd May 2017: How does the FTSE 100 perform before elections? (schroders.com) 22nd July 2024: How Presidential Elections Affect the Stock Market | U.S. Bank (usbank.com) |