Q1 2024 Market Update

While inflationary pressures remain, a combination of time and strategic fiscal manoeuvres by the Bank of England (BoE) has helped bring inflation down to 3.4% in the 12 months to February 2024. At the same time, with inflation remaining higher than the Bank’s 2% target, interest rates have remained static at 5.25%.

As predicted in our Q3 market update, this shows the Table Mountain analogy playing out in reality and, according to rhetoric from the BoE, we are not at a point where interest rates will decrease. At their latest meeting, only one member of the Bank’s Monetary Policy Committee voted to reduce rates. And the Guardian reported that Andrew Bailey, governor of the central bank, said it’s “not yet” time to cut rates, although he did stress that “things are moving in the right direction”.

Meanwhile, the first quarter of 2024 also continued to show positive signs for investors.

In this edition, read expert insight about:

- Tax changes for the new 2024/25 tax year

- The “Magnificent Seven” effect

- Why time in the market, not timing the market is key to successful investing

Tax changes for the new 2024/25 tax year

In March, chancellor Jeremy Hunt delivered the 2024 Budget. One big announcement was a further 2% cut to employee National Insurance.

This means that the main rate of National Insurance will fall to 8%, and Class 4 National Insurance contributions will fall to 6%, effective from 6 April 2024. To put this in perspective, government data shows that an employee with average earnings of £35,400 will save £900 a year in tax.

Though the cuts to National Insurance are good news for millions of people, they aren’t the only points from the recent budgets that could affect you.

Two additional changes may affect you and your financial planning:

- The Capital Gains Tax Annual Exempt Amount has been cut again

Capital Gains Tax (CGT) is charged on profits you make from selling certain types of assets – including personal possessions worth more than £3,000 (excluding your car), property that isn’t your main residence, or investments that aren’t held within a tax-efficient wrapper.

Each tax year, every adult has an Annual Exempt Amount for CGT. If you make profits exceeding this allowance, you’ll be charged CGT on the excess. In 2024/25, the CGT Annual Exempt was halved from £6,000 to £3,000, and to £1,500 for trustees.

- The Dividend Allowance has fallen

If you are in receipt of dividends, you may have to pay Dividend Tax, if the income exceeds the Dividend Allowance in addition to your Personal Allowance.

In 2023/24, the Dividend Allowance was £1,000, but from 6 April 2024, this has also halved – to £500.

The rate of Dividend Tax you pay depends on your marginal rate of Income Tax:

| Income Tax band | Dividend Tax rate |

| Basic rate | 8.75% |

| Higher rate | 33.75% |

| Additional rate | 39.35% |

These changes are expected to drag more and more people into paying tax in these areas, making it more important than ever to make sure you are making regular use of tax efficient investments such as pensions and ISAs.

The “Magnificent Seven” effect

You may have seen the attention-grabbing headlines about the “Magnificent Seven” in the press. Borrowed from the classic western movie, in this case the “Magnificent Seven” are the most popular tech stocks that have enjoyed rapid growth:

- Alphabet (formerly Google)

- Amazon

- Apple

- Meta (formerly Facebook)

- Microsoft

- NVIDIA

- Tesla

Throughout 2023, this small group of tech companies performed exceptionally well. In fact, over the course of 2023, according to CNBC, this elite group of tech giants experienced positive returns of 107%.

With such outstanding performance in an otherwise lacklustre market, it’s perhaps unsurprising that the Magnificent Seven have become such a big story. Indeed, we covered this story in our blog in March 2024.

While you may be tempted to think that you should simply invest in these seven companies, it’s crucial to remember that sensible long-term investing relies on taking a measured approach. And past performance is not a reliable indicator of future performance.

In fact, although Nvidia’s share price continues to climb, along with Meta and Amazon, Apple’s share price has dropped more than 10% and Tesla’s has gone down nearly 33% since the start of 2024.

As such, diversification remains an important factor for your portfolio. We are here to help ensure that your investment portfolio is balanced according to your attitude to risk, your goals, and your investment time frame.

By taking the time to carefully curate your portfolio, and regularly reviewing it to ensure it remains balanced, you give your wealth a much greater chance of enabling you to achieve your long-term goals.

Why time in the market, not timing the market is key to successful investing

Investing can be an emotional ride. Whilst underperformance may create fear, overperformance can be just as nerve-wracking, since you never know when a drop may be imminent.

This may cause you to attempt to “time the market”, meaning you might be tempted to move your money to avoid downturns, and then buy back in to take advantage of the highpoints.

Yet, ultimately, time in the market is likely to create more opportunities to grow your wealth.

While you may feel nervous about your investments during market volatility, historical data suggests that any losses you experience are unlikely to derail your portfolio permanently. And, if you remain invested in a balanced portfolio, it may be possible to recoup losses over time.

Looking back in time reveals reassuring insights that may help you to adjust your thinking. According to data from J. P. Morgan, between 1 January 2003 and 30 December 2022, 7 of the 10 best days happened within 2 weeks of the worst 10 days. And the second-worst day of 2020 was immediately followed by the second-best day of the year.

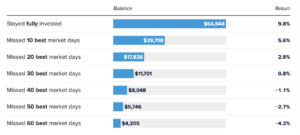

The chart below shows how a portfolio worth $10,000 invested in the S&P 500 between January 2003 and December 2022 would have grown if it had remained invested throughout the entire time compared with an investor who missed the best market days of the same period.

Source: J. P. Morgan

This is a stark reminder of the true value of holding your nerve and remaining invested.

Keeping a calm head when markets are volatile can be hard, but try to remember that, instead of rash reactions, investment decisions should be based on your goals and circumstances.

We’re here to help

As financial planners, we’ve helped clients weather many economic storms over the years, and that’s something we are proud to continue doing.

Markets may rise and fall, but your investment goals should remain the same, and it’s our job to help you achieve them. For almost 20 years, clients like you have trusted us to provide honest, independent advice in a friendly and professional way.

If you have any questions about anything you’ve read in this update, please don’t hesitate to contact your financial adviser, who’ll be happy to give you all the support you need.

Please note:

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Sources:

Bank of England leaves interest rates at 5.25% but signals future cuts. Published 21st March 2024: Bank of England leaves interest rates at 5.25% but signals future cuts | Interest rates | The Guardian

Chancellor delivers lower taxes, more investment and better public services in ‘Budget for Long Term Growth’. Published 6th March 2024: Chancellor delivers lower taxes, more investment and better public services in ‘Budget for Long Term Growth’ – GOV.UK (www.gov.uk)

Magnificent 7 profits now exceed almost every country in the world. Should we be worried? Published 19th February 2024: Magnificent 7 profits now exceed almost every country in the world. Should we be worried? (cnbc.com)

Now is the time to ‘think long term’ when investing, advisor says. This chart helps explain why. Published 9th Oct 2023: This chart helps explain why you should think long term when investing (cnbc.com)